Opinion trading, commonly known as prediction markets, is a financial tool where participants trade on the likelihood of future events. Despite its growing acceptance globally, many in India misunderstand it, often equating it with gambling.

A common misconception is that countries like Taiwan, France, and Singapore have banned prediction markets because they are considered gambling. This is not entirely accurate. These restrictions were placed on specific platforms like Polymarket due to licensing issues and regulatory compliance, not because of the fundamental nature of prediction markets.

Understanding the Distinction: Opinion Trading vs. Gambling

What is Opinion Trading?

- Prediction markets function similarly to stock markets, where participants trade contracts based on future events.

- Traders rely on analysis, data, and probability, rather than luck.

- The purpose is to aggregate collective intelligence and produce accurate forecasts on real-world events.

How Gambling is Different

- Gambling is purely chance-based, with outcomes determined by random events (e.g., casino games, lotteries).

- In gambling, the house always has a built-in edge.

Gambling does not contribute to economic forecasting, research, or policy insights—prediction markets do.

Thus, comparing opinion trading to gambling is flawed and misleading.

Learning from Global Best Practices

The United States: Legalized & Regulated Opinion Trading

The USA has a long history of legal prediction markets, regulated under the Commodity Futures Trading Commission (CFTC).

✔ Iowa Electronic Markets (IEM) – Run by the University of Iowa, this platform has been legally operating since 1988 to predict election outcomes with astonishing accuracy.

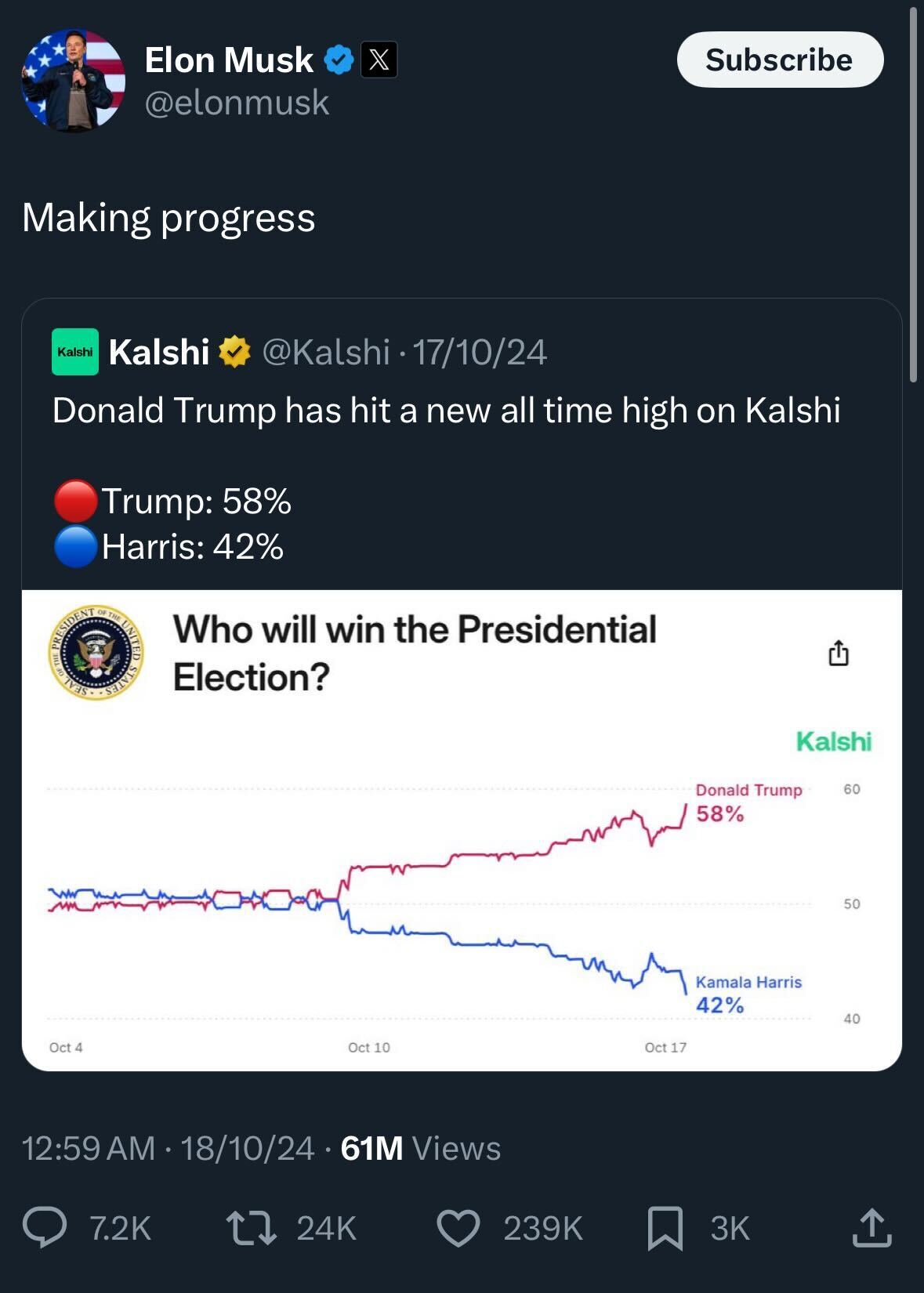

✔ Kalshi – A fully CFTC-regulated prediction market in the US, where users trade on a wide range of real-world topics.

✔ Predict It – A political prediction market that operated under a “no-action” relief from the CFTC, helping researchers and policymakers analyze market-driven expectations.

Key Takeaway for India: The US treats opinion trading as a financial instrument, regulating it under commodity trading laws rather than gambling laws. India can adopt a similar approach under SEBI or a new regulatory framework.

The United Kingdom: Government-Supported Market Forecasting

The UK has embraced prediction markets as a valuable forecasting tool, rather than banning them.

Public Forecasting Initiatives – The UK government has used prediction markets to assess risks, forecast election outcomes, and improve policy decisions.

Key Takeaway for India: The UK uses opinion trading as a legitimate economic tool. Instead of restricting it, India should regulate and integrate it into decision-making for elections, stock market trends, and economic predictions.

India could also explore a hybrid regulatory model, combining SEBI and the Gaming Commission to oversee different aspects of the industry more effectively.

✔ Dual Regulatory Oversight – Financial prediction platforms would fall under SEBI, while event-based predictions (e.g., sports) could be governed by gaming commissions.

✔ Taxation & Transparency – Legal recognition would enable taxation and licensing, ensuring consumer protection, responsible trading, and market integrity.

Why Countries Like Taiwan, France, and Singapore Acted Against Polymarket – and Why India Shouldn’t Misinterpret It

Many in India mistakenly believe that these countries banned prediction markets because they are gambling. This is false.

✔ Singapore’s Ban on Polymarket: Singapore banned Polymarket because it was an unlicensed entity, not because prediction markets themselves are illegal. Singapore’s laws allow regulated financial derivatives.

✔ France & Taiwan’s Actions: Both countries took similar actions against unregulated platforms, but prediction markets still exist in academic and financial circles.

The Real Issue Was Compliance, Not Legality

- These countries have strict licensing and compliance rules that Polymarket failed to meet.

- India should not confuse licensing issues with a fundamental rejection of prediction markets.

If India creates a clear regulatory framework, it can legalize and tax opinion trading responsibly, just like the USA, and UK.

Why India Should Regulate Opinion Trading

India stands at a crossroads. We can either:

1️⃣ Follow countries that banned unlicensed platforms without understanding their economic value, or

2️⃣ Adopt a smart regulatory framework like the USA and UK, ensuring fairness, security, and economic benefits.

Key Benefits of Regulation

✔ Revenue Generation: Legalized prediction markets can generate tax revenue, just like stock markets and derivatives.

✔ Accurate Public Sentiment Analysis: Lawmakers and policymakers can use market insights to gauge public expectations and economic trends.

✔ Consumer Protection: A well-regulated market protects users from fraud and illegal operators, making the ecosystem safer.

In India, Probo is the leading opinion trading platform where users predict future events and trade based on research, analysis, and market news. It offers a dynamic, skill-based experience across categories like sports, economics, and entertainment, empowering users to engage with real-time data and market trends.

India has a chance to be a global leader in regulated prediction markets. We should optimize and utilize them as a powerful financial and economic forecasting tool much like the USA and UK have done.

As Aristotle wisely said:

“The purpose of knowledge is action, not knowledge.”

Now is the time for India to act wisely by fast-tracking the regulation of the opinion market to unlock its full potential.